Is a New Air Conditioner Tax Deductible?

If you’re planning to upgrade your cooling system, you might be wondering, is a new air conditioner tax deductible? While standard AC units typically don’t qualify as tax deductions, energy-efficient models may be eligible for federal tax credits. By installing an ENERGY STAR®-certified AC, homeowners can claim valuable tax savings under the Inflation Reduction Act (IRA) of 2022. In this guide, we’ll break down eligibility requirements, tax credit amounts, and how to claim your savings, helping you make the most of your AC investment.

What Qualifies as a Tax-Deductible Home Improvement?

Tax laws distinguish between home improvements and home repairs, and only certain improvements qualify for tax benefits. Here’s how a new air conditioner may be categorized:

1. Capital Improvements vs. Repairs

- Capital improvements increase a home’s value or extend its lifespan, such as installing a high-efficiency HVAC system. These may be eligible for tax deductions when selling the home.

- Repairs, like fixing a broken AC compressor, are not deductible unless the home is a rental property.

2. Energy Efficiency Tax Credits

- If your new AC system meets specific energy efficiency standards set by the ENERGY STAR® program, you may qualify for federal and state tax credits.

- Tax credits reduce the amount of tax owed, providing immediate savings.

3. Rental Property & Business Use

- Homeowners renting out properties can claim depreciation deductions for HVAC systems.

- Business owners using part of their home for work may qualify for home office deductions, which could cover a portion of the HVAC upgrade costs.

HVAC Systems and Tax Deductions Explained

Many homeowners assume that installing a new air conditioning unit automatically qualifies for tax deductions, but eligibility depends on the purpose of the upgrade and tax laws in place. Below is a breakdown of how HVAC tax deductions and credits work:

1. Federal Tax Credits for Energy-Efficient Air Conditioners

The Inflation Reduction Act of 2022 expanded energy-efficient home improvement tax credits, allowing homeowners to claim up to 30% of the total cost of qualifying HVAC upgrades. Some important details:

- Tax credit limit: Up to $600 for energy-efficient central AC units.

- Split systems & heat pumps: Eligible for credits up to $2,000 if meeting ENERGY STAR® standards.

2. Home Sale Tax Benefits for New HVAC Systems

If you install a new air conditioner and later sell your home, the cost may be added to the home’s cost basis, reducing capital gains tax when you sell. Here’s how it works:

- If you profit from a home sale, the IRS calculates taxable gain by subtracting the adjusted cost basis from the sale price.

- Adding HVAC upgrades to your home’s cost basis can lower taxable capital gains.

3. State & Local Incentives

Apart from federal tax credits, many state and local governments offer:

- Rebates for high-efficiency AC installations

- Property tax exemptions for energy-efficient home improvements

- Low-interest financing options for HVAC upgrades

Key Takeaways

✅ Tax deductions depend on purpose (home improvement vs. business use)

✅ Energy-efficient ACs qualify for federal tax credits

✅ Adding HVAC costs to home’s cost basis reduces taxable gain

✅ State & local incentives offer extra savings

By understanding these factors, homeowners can strategically invest in a cost-effective, energy-efficient cooling system while taking advantage of available tax benefits.

Energy Efficiency Tax Credits for Air Conditioners

With rising energy costs and increasing environmental concerns, homeowners are shifting toward energy-efficient air conditioning systems. But did you know that upgrading to an energy-efficient AC unit can also provide significant tax savings? The U.S. government offers federal tax credits for eligible HVAC systems, making it easier for homeowners to save money while improving home comfort.

In this guide, we’ll break down how energy efficiency tax credits work, which AC models qualify, and how you can maximize your savings.

Federal Tax Incentives for Energy-Efficient AC Units

The U.S. federal government has introduced multiple tax credit programs to encourage homeowners to invest in energy-efficient HVAC systems. These incentives are part of the Inflation Reduction Act (IRA) of 2022, which extended and expanded home energy efficiency credits.

1. What Is the Energy Efficient Home Improvement Tax Credit?

- Under the IRA of 2022, homeowners can receive a 30% tax credit on qualifying air conditioners, heat pumps, and other HVAC upgrades.

- The maximum tax credit for a new energy-efficient central AC unit is $600.

- If you install a qualifying heat pump or combined HVAC system, you may be eligible for up to $2,000 in tax credits.

2. Who Can Claim the Federal AC Tax Credit?

To be eligible for these tax credits, you must meet the following requirements:

✅ You must be the owner of the home where the AC is installed.

✅ The air conditioner must be installed in a primary residence (not rental or commercial properties).

✅ The system must meet energy efficiency standards set by the ENERGY STAR® program.

3. State and Local Utility Rebates

In addition to federal tax incentives, many states and local utilities offer rebates for energy-efficient HVAC installations. These include:

- Instant rebates from utility providers

- Property tax exemptions for energy-efficient upgrades

- Low-interest financing options for eco-friendly home improvements

Qualifying Energy-Efficient Models and Requirements

Not all air conditioning units qualify for tax credits. The IRS and ENERGY STAR® have specific efficiency standards that must be met for eligibility.

1. Minimum Energy Efficiency Requirements

Your new air conditioner must meet or exceed the following ratings:

✅ SEER2 (Seasonal Energy Efficiency Ratio): Measures cooling efficiency.

✅ EER2 (Energy Efficiency Ratio): Higher ratings mean better energy savings.

ENERGY STAR® Certification Requirements

- Central Air Conditioners: Must have a SEER2 rating of at least 16 and EER2 of at least 12.

- Ductless Mini-Split Systems: Require SEER2 of 16 or higher and EER2 of 10+.

- Heat Pumps: Must meet advanced efficiency levels to qualify for $2,000 tax credits.

2. Types of AC Systems That Qualify for Tax Credits

✔️ High-Efficiency Central Air Conditioners

✔️ Ductless Mini-Split Systems

✔️ Geothermal Heat Pumps (Eligible for a 30% federal tax credit with no cap!)

✔️ Smart Thermostats (May qualify for additional rebates)

3. Documentation Needed to Claim Your Tax Credit

To ensure you receive the maximum tax benefits, keep the following documents ready when filing your taxes:

📄 Manufacturer’s Certification Statement (proof that your unit qualifies)

📄 Installation Invoice (showing purchase and installation dates)

📄 IRS Form 5695 (used to claim residential energy tax credits)

Key Takeaways: How to Maximize Your Savings

💡 Choose ENERGY STAR®-certified models to ensure eligibility.

💡 Upgrade your AC before tax credits expire (most credits last until 2032).

💡 Check for local utility rebates to stack savings.

💡 Consult a tax professional for accurate tax credit claims.

Upgrading to an energy-efficient AC unit is not just an investment in home comfort—it’s a smart financial move that can provide long-term energy savings and tax benefits.

Final Thoughts

Understanding energy efficiency tax credits can help you save hundreds to thousands of dollars on your new air conditioning system. Whether you’re considering a central AC unit, ductless system, or heat pump, choosing an ENERGY STAR®-certified model ensures you qualify for maximum tax savings.

By taking advantage of federal incentives, state rebates, and efficiency upgrades, you can reduce your cooling costs while making your home more eco-friendly! 🌍❄️

Homeowner Benefits: Tax Savings on New AC Units

Upgrading to a new air conditioning system not only improves home comfort but also provides financial benefits. Homeowners can take advantage of tax savings, rebates, and incentives to reduce the upfront costs of installing an energy-efficient HVAC unit. However, understanding the difference between tax deductions and credits is crucial to maximizing savings.

In this guide, we’ll explain who qualifies for AC tax deductions or credits and how these tax benefits can help you save money.

Who Qualifies for AC Tax Deductions or Credits?

To benefit from tax savings on your new air conditioner, you must meet specific eligibility criteria set by the IRS and the ENERGY STAR® program.

1. Homeowners Eligible for AC Tax Credits

✔️ Primary Residence Owners – You must install the AC unit in your primary residence (not a rental or vacation home).

✔️ Energy-Efficient Upgrades – Your AC must meet the required SEER2 (Seasonal Energy Efficiency Ratio) and EER2 (Energy Efficiency Ratio) ratings.

✔️ System Purchased and Installed in the Same Tax Year – The purchase and installation must occur in the same calendar year to claim the credit.

2. Business Owners and Landlords

- Rental Property Owners: Can deduct HVAC expenses as a business cost under depreciation.

- Home Office Deduction: If a homeowner uses part of their home for business purposes, they may qualify for partial HVAC tax deductions.

- Commercial Buildings: Energy-efficient HVAC upgrades may qualify for the 179D Energy-Efficient Commercial Buildings Deduction.

3. First-Time Homebuyers & Low-Income Homeowners

If you’re a first-time homeowner or qualify for low-income assistance programs, additional state and utility rebates may be available.

How Tax Credits Differ from Deductions

Many homeowners assume that tax credits and deductions are the same, but they function very differently. Understanding the distinction helps you maximize savings.

1. What Is a Tax Credit?

A tax credit directly reduces the amount of tax you owe. For example:

- If your total tax bill is $2,000, and you qualify for a $600 HVAC tax credit, your new tax bill becomes $1,400.

- The Inflation Reduction Act of 2022 expanded HVAC tax credits to 30% of eligible home energy upgrades, up to $600 for AC units and $2,000 for heat pumps.

2. What Is a Tax Deduction?

A tax deduction lowers your taxable income, which may result in a lower tax bill.

- If you earn $50,000 per year and qualify for a $5,000 HVAC deduction, your taxable income is reduced to $45,000, which could place you in a lower tax bracket.

- HVAC deductions apply mainly to rental properties, home offices, and business use cases.

3. Which One Benefits Homeowners More?

- Tax credits provide immediate savings by reducing the tax owed.

- Tax deductions are beneficial for rental property owners and home businesses because they lower taxable income.

- Homeowners installing energy-efficient AC units should focus on tax credits rather than deductions.

Maximizing Your Tax Savings on AC Installations

💡 Choose ENERGY STAR®-certified AC units to qualify for the highest tax credits.

💡 File IRS Form 5695 when doing your taxes to claim your energy efficiency tax credit.

💡 Consult a tax professional to determine if your home office or rental property qualifies for HVAC deductions.

💡 Stack federal tax credits with local utility rebates for additional savings.

By understanding tax savings on AC units, homeowners can make informed decisions that lead to long-term financial and energy savings.

Final Thoughts

Investing in a new air conditioner is not just about comfort—it’s also an opportunity to take advantage of federal tax incentives and deductions. By selecting high-efficiency HVAC systems and properly filing for tax benefits, you can significantly reduce installation costs and energy expenses.

If you’re considering upgrading your AC, now is the best time to do so while tax credits are available until 2032!

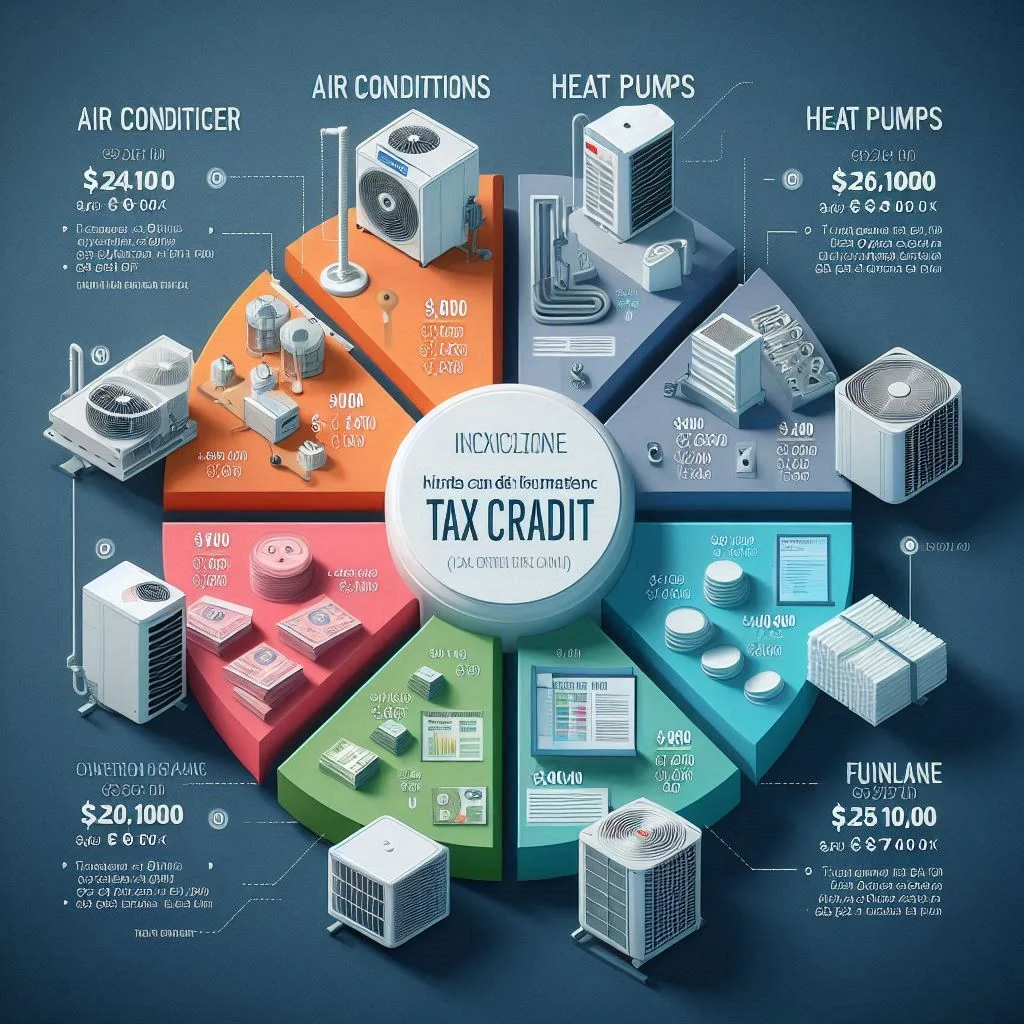

How Much Can You Save? New AC Tax Credit Amounts

Investing in a new, energy-efficient air conditioner not only helps lower your electricity bills but can also provide significant tax savings. Thanks to the Inflation Reduction Act of 2022, homeowners can now claim federal tax credits on qualifying HVAC upgrades. But how much can you actually save?

In this guide, we’ll break down the maximum tax credit amounts for energy-efficient ACs and the separate credits available for different HVAC upgrades, helping you maximize your savings.

Maximum Tax Credit Amounts for Energy-Efficient ACs

The U.S. government provides financial incentives to encourage homeowners to upgrade to energy-efficient air conditioners. The Energy Efficient Home Improvement Tax Credit allows homeowners to claim a 30% tax credit on the cost of qualifying HVAC systems, up to specific limits.

1. Federal Tax Credit for Air Conditioners

✔️ Maximum Credit Amount: Up to $600 for qualifying central air conditioners.

✔️ Eligibility Requirements: The AC unit must be ENERGY STAR®-certified and meet the required SEER2 and EER2 efficiency ratings.

✔️ Expiration Date: This tax credit is available until 2032, giving homeowners plenty of time to upgrade.

2. Tax Credit for Heat Pumps

If you’re considering upgrading to a heat pump, you could qualify for a much higher tax credit:

✔️ Maximum Credit Amount: Up to $2,000 for qualifying heat pumps.

✔️ Why the Higher Credit? Heat pumps provide both cooling and heating, making them more energy-efficient year-round.

✔️ Eligible Models: Must meet ENERGY STAR® high-efficiency standards.

3. What About Installation Costs?

- The tax credit applies only to the cost of the unit and does not include installation fees.

- However, some state rebates and utility programs may offer additional savings on installation costs.

Separate Credits for Different HVAC Upgrades

In addition to tax credits for air conditioners and heat pumps, homeowners can also claim separate credits for additional energy-efficient HVAC upgrades.

1. Tax Credits for Other HVAC Components

✅ Furnaces: Up to $600 for high-efficiency gas furnaces.

✅ Ductless Mini-Split Systems: Eligible for up to $600 if they meet ENERGY STAR® standards.

✅ Boilers: Up to $600 for qualifying energy-efficient models.

✅ Home Insulation & Weatherization: A separate credit of 30% (up to $1,200) is available for insulation, air sealing, and energy-efficient windows and doors.

2. Stacking Tax Credits for Maximum Savings

Homeowners can combine multiple credits for greater overall savings. For example:

- If you replace an old AC unit ($600 credit) and install a heat pump ($2,000 credit), you can claim a total of $2,600 in tax credits.

- Adding home insulation and an ENERGY STAR® smart thermostat can further increase savings.

Final Thoughts: How to Maximize Your Tax Credit Benefits

💡 Choose ENERGY STAR®-certified models to qualify for the highest tax credits.

💡 Plan your HVAC upgrades strategically to take advantage of multiple tax incentives.

💡 Check local and state rebates to combine additional savings with federal tax credits.

💡 Keep documentation (receipts, manufacturer’s certification statements, and IRS Form 5695) for claiming your credit when filing taxes.

Taking advantage of federal tax credits for energy-efficient ACs and HVAC upgrades can lead to significant financial savings while reducing your home’s energy consumption. Now is the perfect time to upgrade your system and enjoy both comfort and cost benefits!

How to Claim an AC Tax Credit on Your Return

Installing a new energy-efficient air conditioner can help you save money on taxes through federal tax credits. However, to claim these credits, homeowners must follow specific IRS guidelines and file the correct forms.

In this guide, we’ll cover the required forms and documentation and walk you through the step-by-step process for filing your AC tax credit successfully.

Required Forms and Documentation

Before filing for an air conditioner tax credit, homeowners need to gather key documents to ensure their claim is valid and approved by the IRS.

1. IRS Form 5695: Residential Energy Credits

- This is the main form used to claim energy-efficient home improvement tax credits.

- Homeowners must fill out the form and attach it to their 1040 tax return.

2. Manufacturer’s Certification Statement

- A written document from the AC manufacturer confirming that the unit meets energy efficiency requirements.

- This document is essential for proving eligibility for tax credits.

3. Proof of Purchase (Invoice or Receipt)

- The IRS requires a detailed receipt or invoice showing:

✔️ Date of purchase and installation

✔️ Model number and efficiency rating

✔️ Cost of the unit (excluding installation fees)

4. Energy Star® Certification

- Your AC unit must be ENERGY STAR®-certified to qualify.

- You can verify the eligibility of your unit on the ENERGY STAR website or in the product manual.

Steps to File for an Air Conditioner Tax Deduction

To ensure you successfully claim your AC tax credit, follow these step-by-step instructions when filing your taxes.

Step 1: Confirm Your Eligibility

✔️ You must be a homeowner who installed the AC unit in your primary residence.

✔️ Your AC system must meet ENERGY STAR® efficiency standards.

✔️ The purchase and installation must have occurred in the same tax year you’re filing for.

Step 2: Obtain and Complete IRS Form 5695

- Download IRS Form 5695 from the official IRS website.

- Under “Residential Energy Efficient Property Credit”, fill out the section for energy-efficient air conditioners.

- Input the cost of the unit (up to the maximum credit of $600).

Step 3: Enter the Credit Amount on Your Tax Return

- After completing Form 5695, transfer the credit amount to Schedule 3 (Form 1040), Line 5.

- This amount will reduce your total tax liability.

Step 4: Attach Required Documents

- Attach Form 5695 to your Form 1040 tax return.

- Keep all receipts and manufacturer certification statements in case of an IRS audit.

Step 5: File Your Taxes

- Submit your tax return electronically or via mail before the April 15 deadline.

- If you’re unsure about filing correctly, consult a tax professional.

Final Tips for Maximizing Your AC Tax Credit

💡 Plan your HVAC upgrades wisely – If you’re also upgrading your furnace, heat pump, or insulation, you can combine multiple tax credits.

💡 Check for additional state and utility rebates – Many states offer extra incentives for energy-efficient home upgrades.

💡 Consult a tax professional – They can help ensure you get the maximum tax benefits for your HVAC system.

By following these steps, homeowners can successfully claim their AC tax credit, reducing their tax bill while enjoying a more energy-efficient home.

Consulting a Tax Professional for Maximum Savings

Claiming tax credits for a new air conditioner can lead to significant savings, but navigating tax laws and IRS regulations can be complex. Many homeowners miss out on potential deductions or make costly errors when filing for energy-efficient home improvement credits.

This is where consulting a tax professional can be invaluable. An experienced tax consultant can help maximize your tax savings, ensure compliance with IRS rules, and prevent common tax credit claim mistakes.

Why Expert Tax Advice Matters

1. Ensuring Maximum Tax Savings

A tax professional can help you:

✔️ Identify all eligible credits for your HVAC upgrades.

✔️ Stack multiple energy-efficient credits, such as combining an AC tax credit with heat pump or home insulation credits.

✔️ Claim deductions correctly to lower your tax liability.

2. Keeping Up with Changing Tax Laws

- Tax laws change frequently, and energy-efficient home improvement incentives can be updated or extended.

- A tax expert stays informed about new IRS rules and can guide you on how to maximize available tax credits.

- For example, the Inflation Reduction Act of 2022 increased the residential energy efficiency tax credit to 30%, but the eligibility criteria may change in future years.

3. Proper Documentation & Compliance

- The IRS requires specific forms and supporting documents when claiming tax credits.

- A tax professional will ensure you:

✅ Use the correct IRS forms (such as Form 5695 for energy-efficient home improvements).

✅ Attach necessary receipts and manufacturer’s certification statements.

✅ Avoid errors that could trigger an audit or credit denial.

Avoiding Common Tax Credit Claim Mistakes

Many homeowners unknowingly make errors when filing for their HVAC tax credits. Here are some of the most common mistakes and how to avoid them.

1. Claiming an Ineligible AC Unit

🚫 Mistake: Not all air conditioners qualify for tax credits.

✅ Solution: Ensure your AC unit is ENERGY STAR®-certified and meets the IRS-required SEER2 and EER2 efficiency ratings.

2. Misreporting the Purchase Price

🚫 Mistake: Including installation costs in the claim (tax credits apply only to the unit cost).

✅ Solution: Report only the eligible portion of the expense as stated on your receipt or invoice.

3. Filing with Incorrect Tax Forms

🚫 Mistake: Using the wrong IRS form or failing to properly transfer credits to your 1040 tax return.

✅ Solution: A tax professional ensures all forms are filled out accurately and submitted correctly.

4. Failing to Claim State or Local Rebates

🚫 Mistake: Many homeowners focus only on federal tax credits and overlook state-level incentives.

✅ Solution: A tax consultant can help you combine federal, state, and utility rebates for maximum savings.

Final Thoughts: Why Professional Tax Guidance is Essential

💡 Expert tax advice ensures you claim the highest possible credits for your HVAC upgrades.

💡 Tax professionals help avoid costly mistakes that could delay or reduce your refund.

💡 They stay updated on IRS changes and can help homeowners plan for future energy-efficient upgrades.

FAQs: Is a New Air Conditioner Tax Deductible?

When considering a new air conditioner, homeowners often ask about potential tax deductions or credits. Below are the most frequently asked questions regarding HVAC tax benefits, along with detailed answers to help you maximize savings and avoid mistakes.

1. Is a new air conditioner tax deductible?

A new air conditioner is not tax-deductible as a standard home expense. However, it may qualify for federal tax credits if it meets energy efficiency standards. Homeowners who install an ENERGY STAR®-certified unit can claim a Residential Energy Credit under IRS Form 5695.

2. How much can I save with an AC tax credit?

Under the Inflation Reduction Act (IRA) of 2022, homeowners can claim up to 30% of the cost of an eligible AC unit, with a maximum credit of $600. If paired with other HVAC upgrades, the savings can be even higher.

3. Do all air conditioners qualify for a tax credit?

No, only high-efficiency air conditioners qualify for federal tax credits. To be eligible:

✔️ The unit must be ENERGY STAR®-certified.

✔️ It must meet SEER2 (Seasonal Energy Efficiency Ratio) and EER2 (Energy Efficiency Ratio) requirements.

✔️ Purchased and installed in the same tax year the credit is claimed.

4. Can I claim a tax credit for an AC installed in a rental property?

No. The Residential Energy Credit applies only to primary residences. Rental properties are not eligible for personal tax credits, though landlords may claim depreciation or business expense deductions instead.

5. How do I claim an air conditioner tax credit?

Follow these steps:

1️⃣ Obtain IRS Form 5695 and complete the section for energy-efficient home improvements.

2️⃣ Enter the credit amount on Schedule 3 (Form 1040), Line 5.

3️⃣ Attach required documents, including:

✅ Proof of purchase (invoice or receipt)

✅ Manufacturer’s certification statement

✅ ENERGY STAR® certification details

4️⃣ File your tax return before April 15.

6. Can I combine AC tax credits with state or utility rebates?

Yes! Many states offer additional rebates and incentives for installing energy-efficient AC units. Homeowners can stack these savings with federal tax credits to further reduce overall costs.

Final Thoughts: Maximize Your AC Tax Savings

- Verify your unit’s eligibility before purchasing.

- File IRS Form 5695 correctly to claim your credit.

- Consult a tax professional to ensure you maximize available tax benefits.

Conclusion:

Investing in a new energy-efficient air conditioner not only improves home comfort but can also provide significant tax savings. While a standard AC unit may not be tax-deductible, qualifying ENERGY STAR® models can earn federal tax credits of up to 30% of the cost. By understanding IRS requirements, properly filing Form 5695, and consulting a tax professional, homeowners can maximize their savings while reducing their energy costs. Additionally, stacking federal credits with state and utility rebates can lead to even greater financial benefits.

If you’re considering an AC upgrade, make sure to choose a qualifying model, save your receipts, and claim your credits correctly to take full advantage of available home energy tax incentives. Want expert advice? Contact a tax professional today and ensure you don’t miss out on these valuable savings!